crypto tax calculator australia

Access by any staff member. Crypto Tax Calculator Australia offers the package deal of 99report in a bundle of 10 at a time.

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Above your trades is a button that says BuysSells CSV.

. This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements. There are 5 ways you could pay capital gains tax on crypto in Australia. Crypto Tax Calculator Australia Coffs Harbour New South Wales.

653 likes 10 talking about this. Login to your Coinspot account. This package is offered to SMSF.

Exchange crypto for crypto including stablecoins. The bottom-bracket tax rate is set at 1211 and is applicable to anyone. Buy goods and services if not.

If you want to work out your profits for more coins click the Add Coin button and fill out the relevant fields for the additional coins. If you have your trading history in an excel sheet this guide will show you how to convert it into the. The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold.

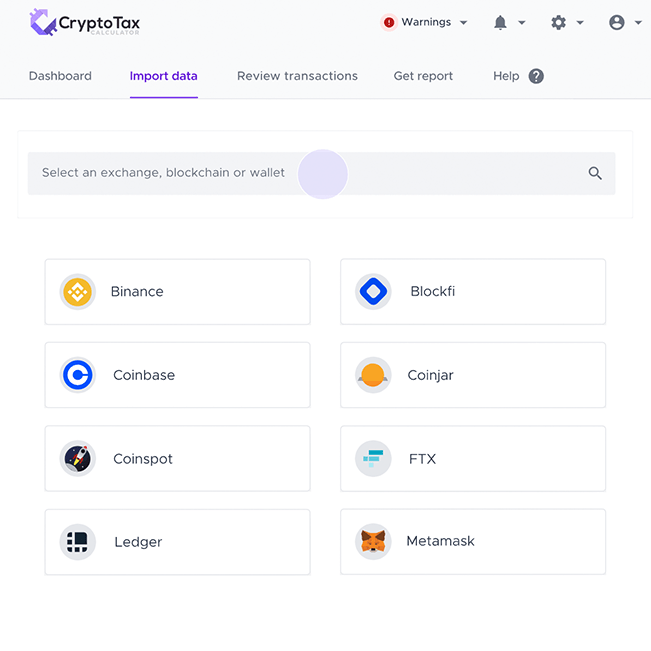

This is automatically calculated. At the top right click on the drop down menu on your account information and select Order History. You can import data for.

Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Swyftx Evaluation 2022 Finest Crypto Currency Exchange for Australia Market Free Crypto Tax Calculator Australia. At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously.

The tax rate on this particular bracket is 325. CSV file uploads are the main upload format used in our crypto tax calculator application. Exchange crypto for fiat.

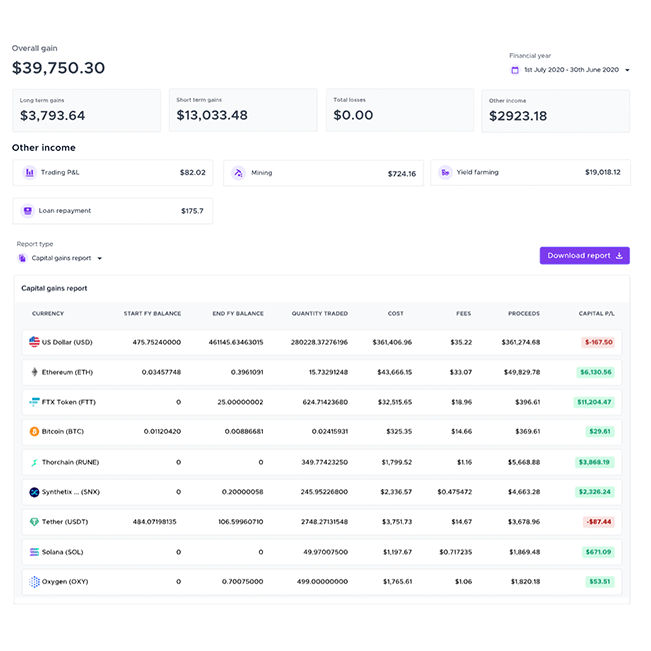

Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years. The municipal taxes usually vary but on average its around 25. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in.

The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. The free trial does not have an. By now everyone has actually become aware of.

Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain. Using The Australian Cryptocurrency Tax Calculator. We can help you calculate your crypto tax in Australia with our simple and easy to use.

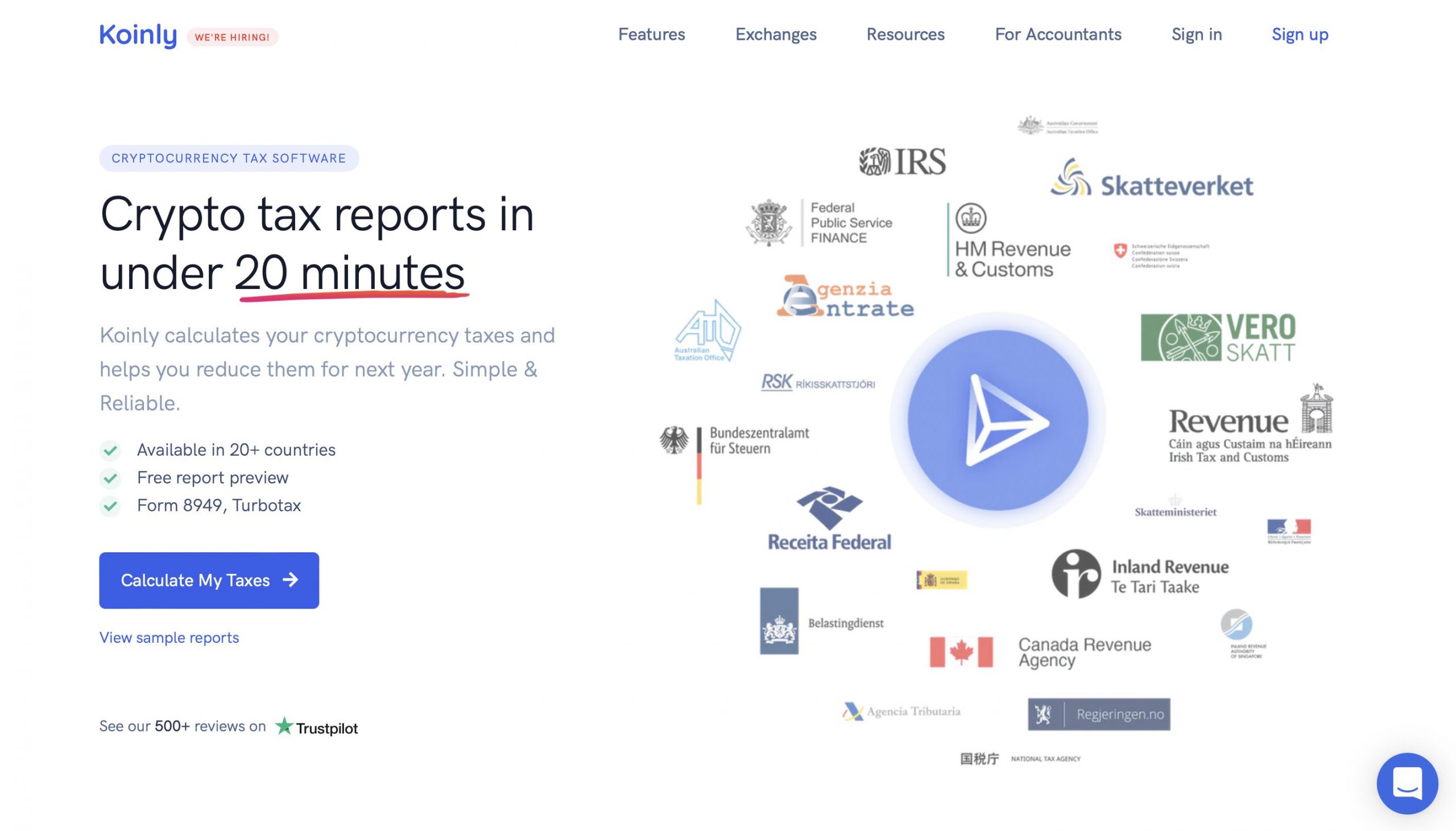

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

11 Best Crypto Tax Calculators To Check Out

Crypto Tax In Australia The Definitive 2022 Guide

Cryptoreports Google Workspace Marketplace

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Calculate Your Crypto Taxes With Ease Koinly

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

11 Best Crypto Tax Calculators To Check Out

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

11 Best Crypto Tax Calculators To Check Out

Best Crypto Tax Software Top Solutions For 2022

11 Best Crypto Tax Calculators To Check Out

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency